Pakistan fintech Neem has raised $2.5m in seed funding round, furthering its mission of bringing financial wellness to the country’s underbanked communities – both individuals and businesses.

Neem’s ambition is to bring an embedded finance model to Pakistan with a market opportunity of $167bn. Investors include SparkLabs Fintech, leading investment house in Pakistan Arif Habib Ltd, Cordoba Logistics & Ventures Ltd, Taarah Ventures, My Asia VC, Concept Vines, Building Capital, Partners at Outrun Ventures and strategic angels as CSO of tech house BPC, Founding Partner at Mentors Fund, as well as fintech veteran and ex-CEO of Seccl and others.

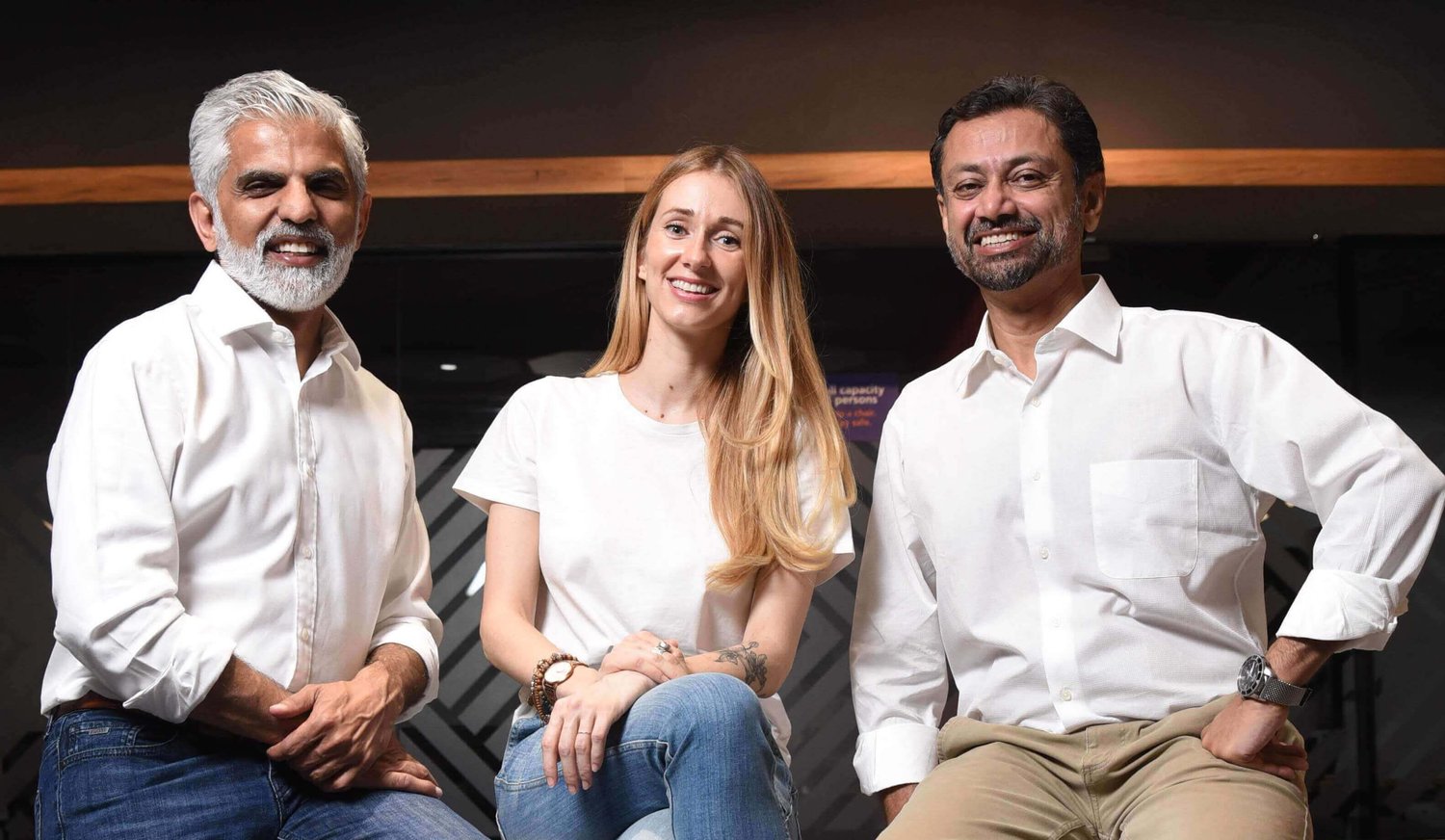

Neem was founded by Nadeem Shaikh, Vladimira Briestenska and Naeem Zamindar

The company believes that financial inclusion requires a shift towards a more holistic approach catering for the full financial needs of people and businesses, a Financial Wellness model. This includes giving individuals and businesses control through payments; addressing their needs through credit; absorbing risk through access to insurance, and at the top of the financial wellness pyramid sits financial freedom through savings and investments.

According to State Bank of Pakistan data, almost 53% of Pakistan’s adult population and 3.3 million MSMEs are currently financially excluded. Neem is seamlessly embedding financial products and services into underbanked communities across diverse sectors including agriculture, MSMEs, e-commerce, logistics, healthcare, and others.

- IT outage rocks the world

- Low-cost artificial ‘muscles’ developed for safer, softer robots

- BaaS on the rise

- FM61 boosts Morocco’s startup ecosystem

- ORA Tech raises US$1.5m

Neem’s embedded finance platform includes two core offerings; a Banking as a Service (BaaS) platform and a lending platform. Neem’s BaaS platform allows partners to embed wallets and payments into their communities as well as offer financial products such as insurance and savings customised to the community’s needs. Neem’s lending platform allows partners to provide tailored lending products for both consumers and MSMEs.

Embedded finance and API-first tech architectures are globally recognized as the future of financial services with a market opportunity of $7 trillion, solving for the financial wellness gap.

Neem believes that Embedded finance can help accelerate Pakistan’s economic growth by making financial services accessible and affordable to all at the point of experience, available on-demand. Global financial services experts at Bain, McKinsey and 11FS believe that embedded finance marks a new era in how consumers and businesses build and manage their relationship with financial services.